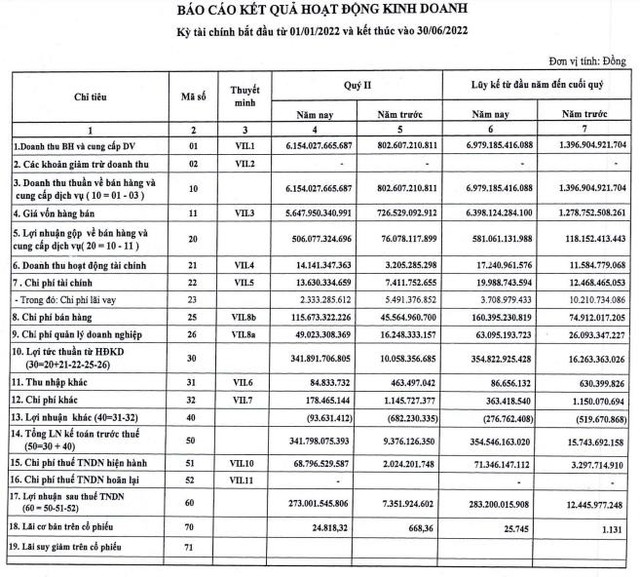

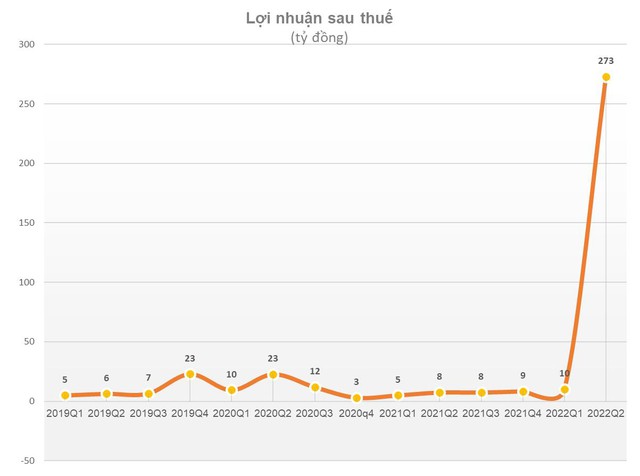

Coalimex’s Q2 net revenue reached VND 6,154 billion, 7.7 times higher than the same period last year; profit after tax of 273 billion dong, 37 times higher than the same period in 2021, only 7.4 billion dong.

Coal Import – Export Joint Stock Company – Vinacomin (Coalimex – HNX: CLM) has just announced its Q2 financial report. Accordingly, Q2 net revenue of CLM reached VND 6,154 billion, 7.7 times higher than the same period. After deducting the cost of goods sold, CLM’s gross profit reached 506 billion dong, 6.7 times higher than the same period last year, only 76 billion dong.

In addition to the increase in sales and service provision, CLM’s financial income also increased sharply to more than 14 billion dong, equaling 4.4 times the same period last year, mainly due to exchange rate differences due to buying and selling, foreign currency payments in the period.

Xem thêm về văn bản nguồn nàyNhập văn bản nguồn để có thông tin dịch thuật bổ sung

Gửi phản hồi

Bảng điều khiển bên

Expenses also increased sharply, in which, financial expenses increased by 84% to 13.6 billion VND, selling expenses increased by 1.5 times to 116 billion VND and general and administrative expenses increased 2 times to 49. billions dong.

As a result, CLM reported a pre-tax profit of nearly VND 342 billion and profit after tax of VND 273 billion, 37 times higher than the same period in 2021 with a profit of only VND 7.4 billion.

In the first 6 months, CLM recorded a net revenue of VND 6,979 billion, 5 times higher than the same period of the same period and a profit after tax of VND 283 billion, equaling 22.7 times compared to the same period in 2021.

Earnings per share (EPS) of CLM in Q2 and 6 months were VND 24,818 and VND 25,745 respectively. This result puts CLM past PAT of Vietnam Phosphorus Apatite to become the stock with the highest EPS in the market ( PAT’s 6-month EPS is 21,868 dong).

In 2022, CLM only set a revenue target of VND 5,500 billion and profit of VND 36 billion, thus, after 6 months, the company has completed 127% of the revenue plan and 786% of the profit plan.

The company explained that the reason for the high revenue was that in the first 6 months of 2022, the demand for coal supplied to thermal power plants increased, so the Company promoted coal import and coal blending. Specifically, the volume of imported coal in the first 6 months of 2022 is 1.14 million tons (the same period in 2021 is 163 thousand tons); blended coal is 240 thousand tons (it is 157 thousand tons in the same period in 2021).

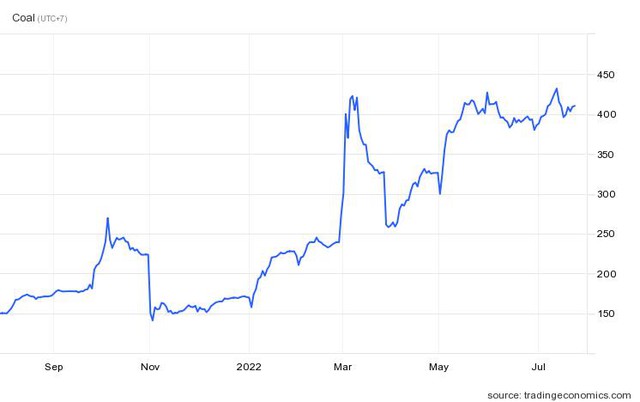

At the same time, due to the influence of the Covid-19 pandemic, political tensions between Australia and China and especially the war in Ukraine, the world coal price has increased sharply from the end of 2021 until now. Specifically, the GlobalCOAL Newcastle Australian coal price index (6,000 kcal/kg NAR) as well as Vietnam’s export coal price at the end of June 2022 increased by about 300% over the same period in 2021.

Coal futures price in Newcastle, the standard price for the Asian market (Source: tradingeconomics.com)

Coal output and selling price increase, leading to corresponding increase in profit.

Besides, a number of business fields such as office leasing, labor export, … started to prosper after the period of control of the Covid-19 epidemic compared to 2021.

In particular, the Company has successfully implemented a number of international bidding packages to supply coal for domestic steel mills with high profit rates.

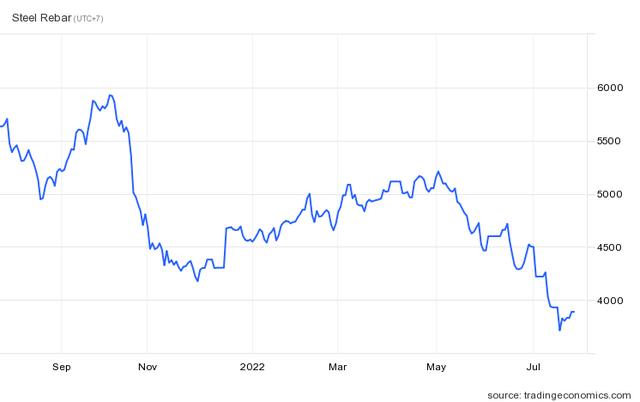

It is known that coal is the input fuel accounting for the highest proportion in the iron and steel production process. The price of coal makes coal businesses large, but it puts great pressure on the production input costs of the steel industry.

Besides, the output of products, the price of steel decreased, specifically, the domestic steel price has decreased 10 times in a row in 10 weeks with the highest total decrease of more than 3.6 million VND/ton, depending on the brand. , steel type and region.

Rebar futures prices in China (source: tradingeconomics.com)

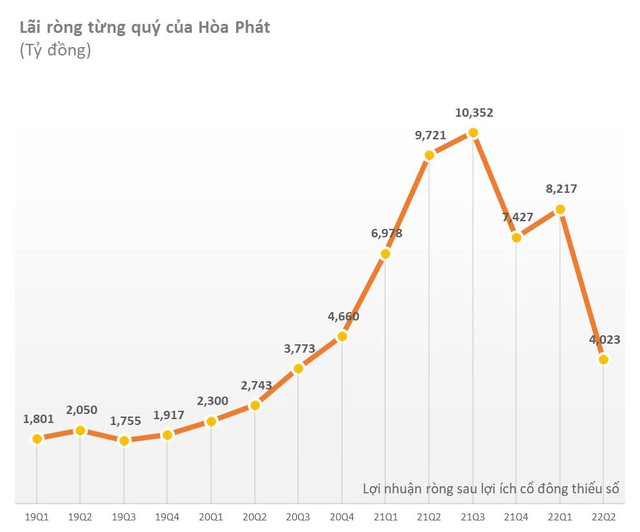

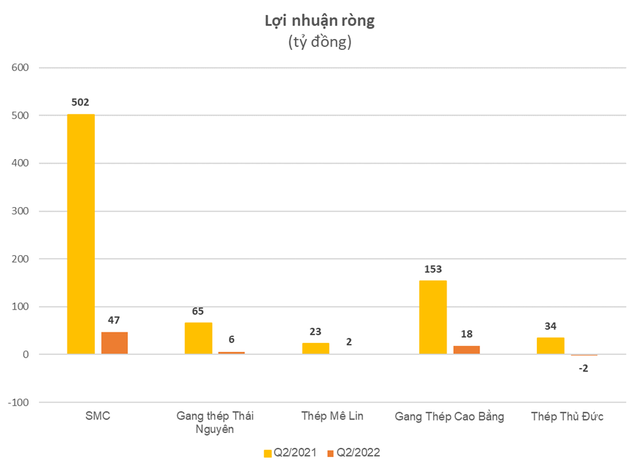

Market movements have a great influence on the profit margin of steel companies, many enterprises have reported a deep decrease in profits in the quarter such as Hoa Phat, Tien Len Steel, SMC, Thai Nguyen Iron and Steel, Me Lin Steel, Cao Bang Iron and Steel, Thu Duc Steel.

On the balance sheet, the total assets of CLM as of June 30th reached VND 1,827 billion, equal to 2.3 times at the beginning of the year, accounting for the majority of which are short-term receivables. The amount of money CLM holds is 185 billion dong, up 6.3 times at the beginning of the year, inventory value also increased by 75% to 343 billion dong.

On the capital side, total debt increased 2.3 times to VND 1,376 billion and equity also increased to VND 451 billion due to high profit in the period. The debt/equity ratio is 3.

On the stock market, at the end of trading day on July 26, CLM’s share price increased by 6,100 dong/share, corresponding to a ceiling increase of 10% to 67,200 dong/share, this is the 4th consecutive ceiling increase session of the stock. promissory note.

At the current price, the market capitalization of CLM reaches VND 672 billion, 2.2 times the total net profit of the last 4 quarters, equivalent to a P/E ratio of only 2.2 times.