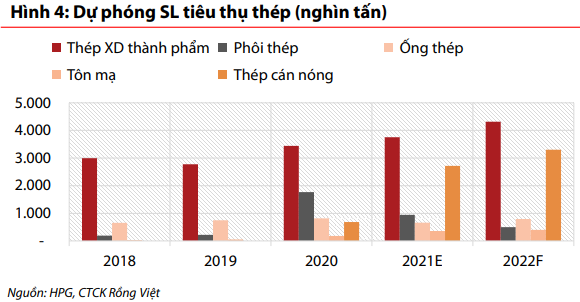

VDSC believes that the price of hot rolled steel (HRC) of Hoa Phat (HPG) in the third quarter will continue to increase to $960/ton and remain at $900/ton in the fourth quarter of 2021. Therefore, HPG can achieve a gross profit margin of 38.5% in the second half of this year.

In the newly released report, Viet Rong Securities (VDSC) assessed that most industries reported strong growth in the first 6 months of 2021 mainly based on last year’s low. Notably, the steel industry increased sharply due to the sharp increase in prices of many related goods, which was caused by recovering demand and while the supply chain was disrupted.

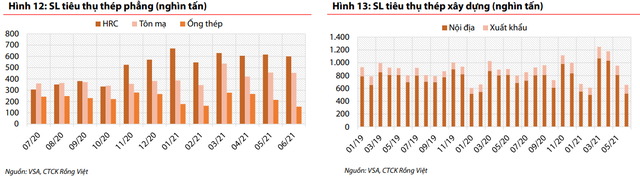

The steel industry benefits mainly from exports when domestic demand declines

For the steel industry outlook, the expectation that the prolonged price increase of some commodities may continue to be a support, especially the factor from the overseas market. According to VDSC, Vietnamese producers will benefit as competitive pressure eases and steel prices remain high until the first half of 2022 due to rising production costs and falling output in China; while demand in the US and EU markets remains strong.

In the first half of 2021, the context of rising raw material prices contributed to the increase in steel prices. VDSC forecasts that iron ore prices can remain at $160/ton in 2022, so the cost of producing liquid iron from BOF furnaces will continue to be high and steel prices are unlikely to fall.

In the last 6 months of 2021 and the whole year of 2022, steel demand in Europe is forecasted to increase, reaching 10.2% in 2021 and 4.8% in 2022. Vietnam. EU safeguard measures were extended for imported steel, mainly targeting rivals such as China, India, South Korea and Turkey, while Vietnamese producers such as NKG, HSG received Full orders until November.

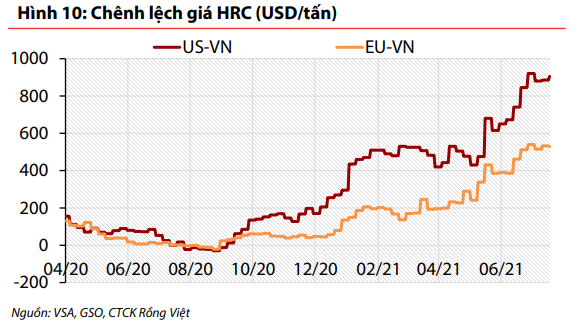

The HRC price difference between the EU and Vietnam is widening and fluctuates in the range of 300-530 USD/ton, from which it is estimated that the gross profit margin of steel exporters in Vietnam can range from 15%- 25% in the second half of 2021, then down to about 14% in 2022, still higher than 2018-2019.

Hot rolled steel (HRC) segment will be positive thanks to strong demand from downstream producers. Accordingly, the selling price of HRC in the third quarter remained high thanks to strong export demand to EU-North America markets – markets that banned steel originating from China.

In 2022, VDSC expects HRC consumption to remain high and the high steel price gap between Europe-North America and Vietnam allows HPG and Formosa to export at a high profit when steel prices are competitive. Therefore, HPG and Formosa will still have high profit and sales volume in the second half of 2021 in the HRC segment.

In contrast, the construction steel segment will be weak in demand in the short term and production costs will increase, which will put pressure on the gross profit margin of construction steel manufacturers in the second half of this year. Consumption may recover in Q4 thanks to seasonal factors and projects are delayed in Q3, however, still depends on disease situation. Until 2022, after the epidemic, demand will be able to recover.

Hoa Phat (HPG) maintains good profit thanks to high steel price and strong HRC demand

According to VDSC, HPG’s hot-rolled steel (HRC) price in the third quarter will continue to increase to $960/ton, and is expected to remain at $900/ton in the fourth quarter of 2021. Therefore, HPG can achieve a gross profit margin of 38.5% in the second half of this year.

However, the construction steel segment is not evaluated positively as demand may weaken in the second half of the year due to the impact of pandemic control measures. VDSC estimates HPG’s second half revenue and NPAT will reach VND 77,000 billion (+53%YoY) and VND 16,300 billion (+ 93%YoY), respectively.

The export of galvanized sheet brings profit to Hoa Sen (HSG)

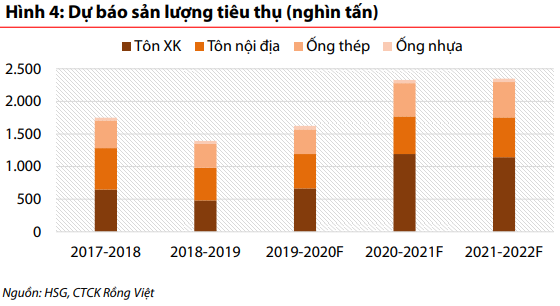

At HSG, strong overseas demand will allow the company to operate its galvanizing steel mills at full capacity in the second half of 2021. The company has received enough overseas orders for production. until November-December, according to which export volume in the fourth quarter may increase by 10% compared to the previous quarter, while consumption in the domestic market may decrease by 11%.

Besides, export gross profit margin may increase to 19.5% in the fourth quarter. Export volume to highly profitable markets such as the EU and the US may increase by 120% q-o-q to the level. 183,000 tons in Q4. VDSC expects that HSG’s export volume can reach 1.1 million tons in fiscal year 2021-2022, down slightly by 4% but still high compared to previous years. HSG’s business scenario in fiscal year 2020-2021 is revenue of VND 13,095 billion (+57% YoY) and EAT of VND 1,100 billion (+144% YoY).

Nam Kim Steel (NKG): Export is the driving force for growth

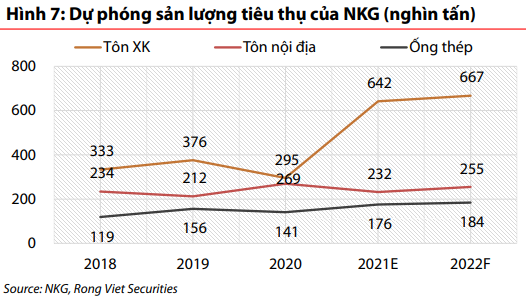

In the context of the weakening domestic market, strong export activity will offset when NKG has received enough export orders until November, allowing factories to operate at full capacity in 2021. NKG may achieved a high export profit in the second half of this year compared to the same period last year as the company accumulated a large amount of HRC at low prices in June, along with the widening HRC price gap between Europe and Vietnam. wide.

Currently, NKG is building a new warehouse and moving its steel pipe production line to a new factory, increasing its steel pipe capacity by 80% to 330,000 tons. VDSC forecasts revenue and EAT of VND16,350 billion, +140% and VND1,160 billion, and +390% YoY respectively in the second half of 2021. Full-year net profit is forecast at VND2,260 billion.